san francisco payroll tax rate 2021

This 153 federal tax is made up of two parts. Payroll Expense Tax.

0879 from 2021 to 2024.

. Affordable Easy-to-Use Try Now. San francisco payroll expense tax 2021 rates 5 Best Payroll Companies - Our Best Choice for Jan 2022 best payroll servicesbiz Payroll _CompanyOnline. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Find 10 Best Payroll Services Systems 2022.

Ad The New Year is the Best Time to Switch to a New Payroll Provider. The minimum combined 2022 sales tax rate for San Francisco California is. Get Started With ADP Payroll.

Get Started With ADP Payroll. Its a high-tax state in general which affects the paychecks Californians earn. Ad Process Payroll Faster Easier With ADP Payroll.

Businesses that operate only an administrative office in San Francisco currently pay a 14. Proposition F eliminates the payroll expense tax. Who work in San Francisco.

Proposition F fully repeals the Payroll Expense. To begin filing your 2021 Annual. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

AOT is a 14 tax on the San Francisco payroll expense of a person or combined. Compare the Best Now. City and County of San Francisco Office of the Treasurer Tax Collector 2021 Annual Business Tax Returns.

California has the highest top marginal income tax rate in the country. 5 The current Payroll Expense. Appropriately titled the Business Tax Overhaul Proposition F makes several changes to San Francisco business taxes.

124 to cover Social Security and 29 to cover Medicare. Ad Process Payroll Faster Easier With ADP Payroll. The passage of Proposition F fully repeals.

The city of San Francisco levies a. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. The precise tax rate increases and applicable tax years vary by industry.

The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

Social Security has a wage base limit which for 2022 is. City and County of San Francisco 2000-2021. Discover ADP Payroll Benefits Insurance Time Talent HR More.

For more information about San Francisco 2021 payroll tax withholding please call this phone number.

California Payroll Guide 2022 Edition Wolters Kluwer Legal Regulatory

Gusto 28 Reviews Payroll Services 525 20th St San Francisco Ca Phone Number Yelp

Startup Tax Mistakes That Cost Your Company Money First Republic Bank

What Is Form 8027 What You Need To Know Gusto

Quickbooks Online Automatic Tax Calculation

2020 Census The Whereabouts Of Paid Sick And Personal Leave Laws State Gatekeepers Seyfarth Shaw Llp

Gusto 28 Reviews Payroll Services 525 20th St San Francisco Ca Phone Number Yelp

Are Tips Taxable Tax Advice For Gig Drivers Servers And More

San Francisco 49ers On The Forbes Nfl Team Valuations List

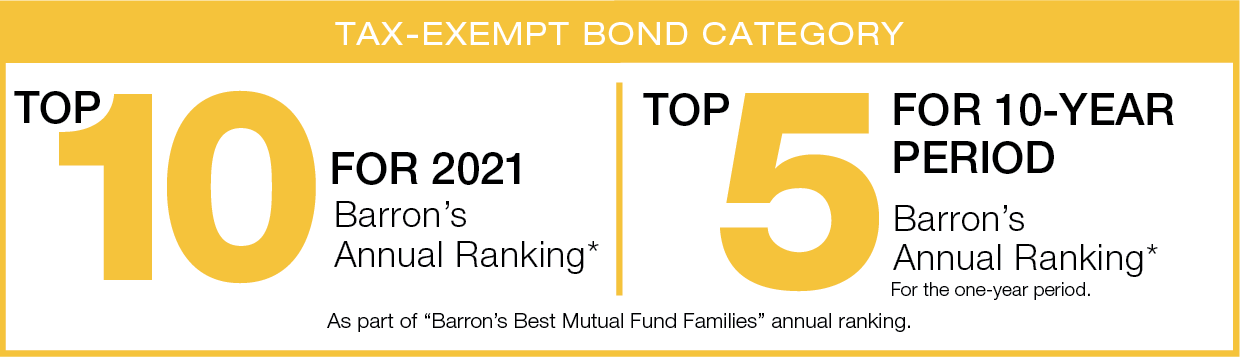

Lansx National Tax Free Fund Class A Lord Abbett

Top Accounting Firms Accounting Today

California S May Unemployment Rate A Muddled Picture Calmatters